Gather Your Documents

The Internal Revenus Service (IRS) requires tax prepare to make a file for every customer and request certain documents.

In order to get you ready for tax season, let go over the requirements.

Contact us

Personal Information

- State Identification or Driver's License for Everyone on your Return

- Social Security number or individual tax ID number (ITIN) for Everyone on your return.

- Make sure your name is the name on record with the Social Security Administration - notify SSA if you change your name.

- Bank account and routing numbers to get a refund or pay by direct deposit

- Last years Tax Return, if you did not file with us. Return should include your adjusted gross income (AGI) and exact refund amount from your last tax return.

- Your current address — notify IRS if you changed your address

- If you e-filed last year with another company, your self-select PIN (should be on last years tax return)

- If you were a victim of identity theft, your IP PIN, this is required in cases of identity theft.

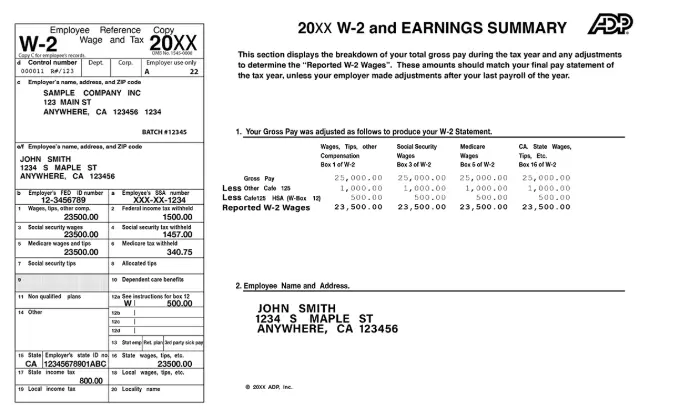

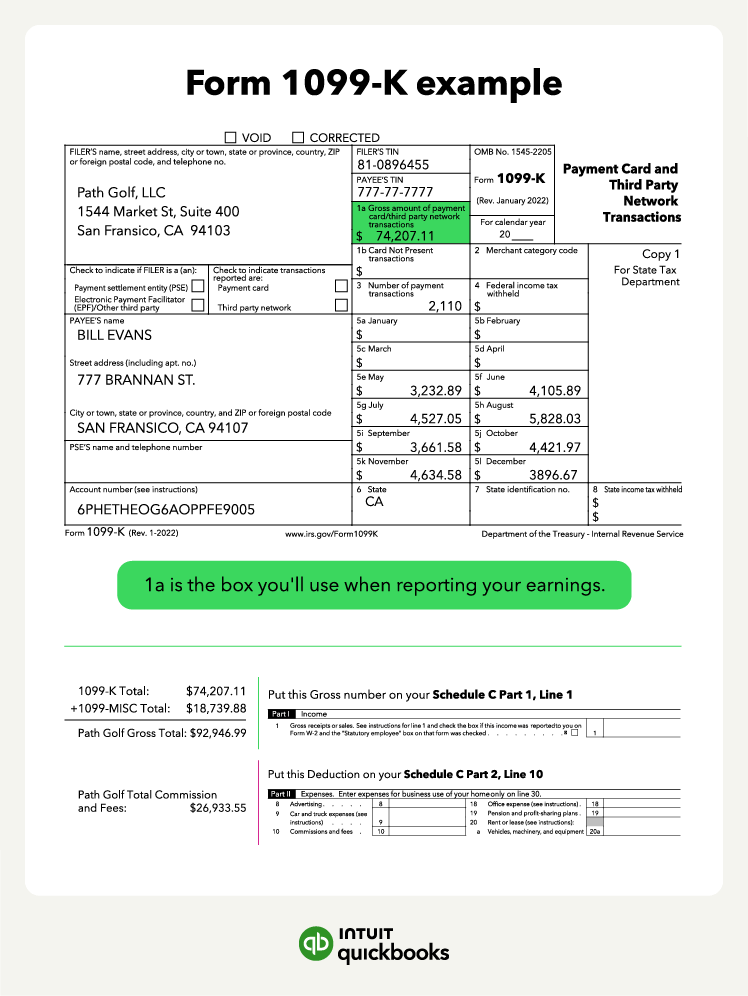

Statements

Banks, payments apps, card processor or online marketplaces

Checks Paid

to You

Receipts & Mileage Log

include Travel, gift and car expenses

Record of Deductible Expenses

include estimate tax payment paid