Forms

Thank You for Choosing Paragon Parcel Companies

We are please to work with you this tax season to get your return completed in a timely manner.

Please submit the required documents so we can get you going.

"What Can PINK Do For You!!!"

Office: (713) 885-9075

Email: taxclients@paragonparcel.com

www.paragonparcel.com

Ready to File

Lets Get Started

Review

Who can be a dependent?

Required Documents

Complete the following forms

Customer Intake form

Direct deposit form

Who Can Be a Dependent?

One Of the biggest issues for most taxpayers is what is and who really is a dependent?

A dependent is a qualifying child or relative who relies on you for financial support. To claim a dependent for tax credits or deductions, the dependent must meet specific requirements. IRS General Rules for Dependents

Answer questions to see if you can claim someone as a dependent on your tax return

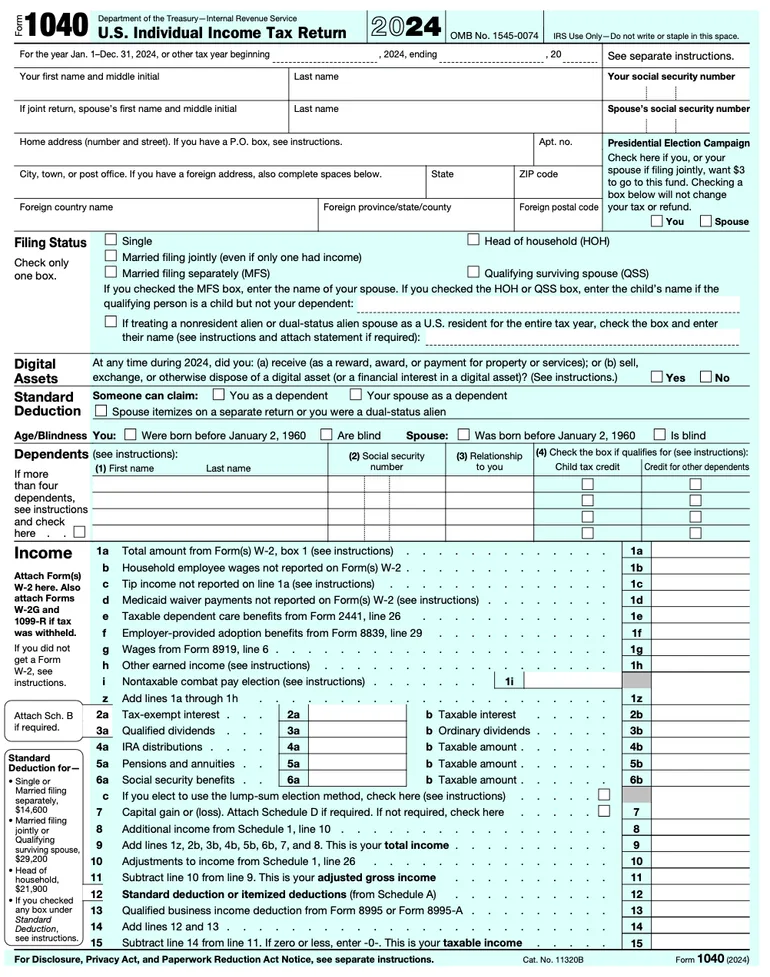

Tax Preparation Forms

Road Maps to completing your tax return.

Required Documents

New and Returning Customers please review the form

- As preparers we are required to retain certain documents.

- See what we require at PPC

Addition information - Gather Your Documents - IRS

Thinking About Taxpayer Advance Loan

Loan up to $7,000. No Cost loans starting at $250 to $1000, funded quickly. Loans $1250 and over are interest bearing. APR is 36%

Estimate Calendar

Filing a Paper Tax Return

So you wanna use snail mail to file your return. We can still prepare you return and mail it to the IRS or you can mail it yourself. It must be postmarked by April 15th (varies depending the day of the week April 15th fall. Here the address for mailing your return.

SCAM ALERT

Scammers calling multiple time through the day. The IRS is encouraging IP PIN. Once you apply you'll receive a and specialized PIN each year to file with you taxes.

Identity Theft Pin (IP PIN)

If you have ever put a pin number on your tax return with the IRS and cannot remember the number or need to file for a number click the link above to be taken to the IRS website. Link to Form 15227 to request a IP PIN for the first time

Business Owners

If you are an Independent Contractor (IC), Self - Employed, etc. You may have expenses to reduce your tax liability.

IC jobs or side hustles could include Uber, Lyft. Instacart, Shipt, Scentsy, MaryKay, Avon, LiveOps, Freelance work, etc.

Here's a form to use as a guide or you can prepare your own. Expense Sheet.

Resources from the IRS - Credit & Deductions for businesses and Guide to business expense resources

- Need a Side Hustle (No Endorsement by PPC-just research) - 50 Easy Ways You Could Make Extra Money This Month.

- We will add more resources for business owners in the future, please let us know if you want to subscribe.

No Legal Advice Given

DISCLAIMER: Thank you for being a valued part of our business. However, please be advised we can not offer legal or financial advice. Any information is based on previous experience, studied case and knowledge (opinions) gave through the combine 60 years experience that my firm possess. If you need more assistance, please consult an attorney or CPA.

Other Services Provided

Why Choose Paragon Parcel

so you can put the focus on what you want!

We got you covered!!